512.904.9900

Public Adjusters

Claim Assistance Available 24/7

"Leaky Roof? Get It Fixed Fast – Book a Free Inspection Today!"

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Are you tired of hearing that [Common Belief] is the only way to achieve [Desired Result]? What if we told you there’s a faster, simpler way to get the results you want, without the stress and hassle of [Common Belief]?

Licensed & Insured Roofing Experts

Lifetime Warranty on Materials

Fast, Free, No-Obligation Inspections

Certified Roofing Company

Texas Flood Damage Insurance Claim?

Start Your Flood Recovery with Confidence

Licensed Insurance Policyholder Advocates

500+ Satisfied Policyholders and Counting

Non-Litigious Solutions

Over $250,000,000 Recovered

INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

Don’t Settle for Less — Texas' Trusted Large-Loss Flood Claim Public Adjusters

Texas Flood Damage Insurance Claim? Get the Settlement You Deserve

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

Certified Water Restoration Technician

IICRC™ Certified & Ready to Help

Our licensed public adjusters understand the IICRC S500 Standard for Professional Water Damage Restoration protocols.

Industry-Leading Experts in Large-Loss flood Claims

We Challenge Underpaid & Denied Claims

Detailed Claim Representation and Consultation

We Empower Policyholders

Flood Experts

Don’t Let Flood Damage Cost You Thousands—We Fight for Maximum Payouts

Floods wreak havoc on commercial and residential properties, but insurance companies often undervalue or delay payouts. We make sure policyholders receive every dollar they’re owed.

Recover more for your storm damage claim.

Fast, strategic, and expert-backed insurance claim solutions.

Get a hail damage claim review today—don’t leave money on the table

Flood Claim Experts

Whether you're just starting your flood claim or facing delays, denials, or underpayments—

We can help you get the Settlement You Deserve!

If your claim has been delayed, denied, or lowballed, it’s time to take action. Insurance carriers often dispute hail damage claims—but we have the expertise to prove the real extent of your losses.

Public Adjusters for Residential, Commercial & Multi-Family Claims

We Fight Insurance Tactics That Reduce Payouts

Helping Policyholders Recover Fair and Prompt Settlements

35 + Successful Projects

Local Roofing Experts

100% Guarantee

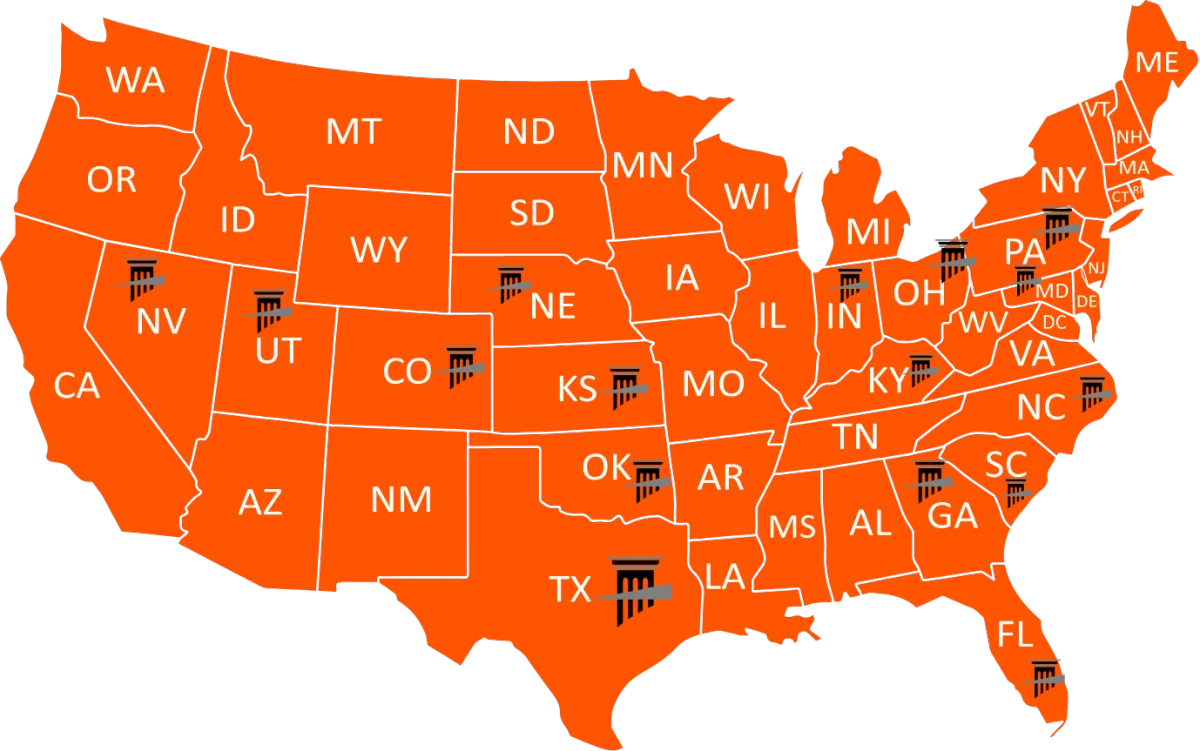

Licensed Public Adjusters In 16 States:

Insurance Claim Recovery Support

Public Adjusters • Policyholder Advocates

No Recovery, No Fee

Large-Loss Representation*

We don’t get paid unless you do.

Proven Results

Successfully settled hundreds of millions in property damage claims.

Expert Representation

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

We maximize settlements without unnecessary legal battles.

Licensed Public Adjusters Nationwide

We work exclusively for policyholders, not insurers.

Verifiable Success

Increased settlements over initial offers by 20% to 3,830%+

Texas' Trusted Flood Claim Experts

IICRC-Certified & Ready to Help

Navigating a large property damage claim? Our HAAG-certified adjusters specialize in identifying storm-related losses insurers often overlook. We ensure Texas business owners get the full value of their policies—no excuses, no delays.

35 + Successful Projects

Local Roofing Experts

100% Guarantee

Build Roof Standard

Licensed & Insured

Providing Quality

Leaks and water damage

Why Choose ICRS TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

20+

Years Of Experience

500+

Large-Loss Claims Settled

130,160

Hours Worked

$450,000

Average Claim Amount

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

Texas Flood Damage Insurance Claims?

Frequently Asked Questions

Does my homeowners insurance cover flood damage?

No. Standard homeowners and commercial property insurance policies typically exclude flood damage. You need a separate flood insurance policy (NFIP or private).

What should I do first if my property has been flooded?

Start by documenting all damage with photos and videos. Contact your insurer or public adjuster and begin mitigation efforts to prevent further loss.representation.

Why Acting Fast Matters

Understanding your contractual obligations as a policyholder and the responsibilities your insurance provider owes you is crucial to avoiding unnecessary liability and risk. The longer damage remains unmitigated, the greater the risk of mold, moisture intrusion, structural weakening, and increased liability.

Can I still file a claim if I don’t have flood insurance?

While you can’t file a flood claim without insurance, you may qualify for FEMA grants, SBA loans, or local aid.

What is a Proof of Loss, and do I need one?

A Proof of Loss is a sworn statement that details the amount of your claimed damages. For NFIP claims, it must be submitted within 60 days unless extended.

How long do I have to file a flood insurance claim?

You should notify your insurer immediately, but NFIP policies generally require claims and Proof of Loss submission within 60 days of the flood event.

How can a public adjuster help with my flood claim?

Public adjusters represent you (not the insurance company) and help with damage documentation, claim filing, settlement negotiation, and maximizing payout..

I have flood insurance but my claim was denied or underpaid. Can I appeal?

Yes. You can dispute the settlement or denial through appeal, reinspection, appraisal, or by hiring a public adjuster to reopen and strengthen your claim.

What types of damages are typically covered under flood insurance?

Covered damages often include foundation, walls, flooring, HVAC, water heaters, and permanently installed appliances—but not landscaping or external decks.

What if my business suffers from lost income after a flood?

NFIP does not cover business interruption. However, some private policies or special endorsements might. A public adjuster can help review your coverage.

Do I need to wait for an insurance adjuster before starting repairs?

Yes and No. Knowing what to repair immediately versus what to wait on can protect your insurance claim and avoid denied or reduced coverage. Here's a detailed breakdown for policyholders dealing with flood or property damage:

You should begin emergency mitigation (like water removal) immediately after taking photos and video of all affected areas holding moisture. Save all receipts and document everything thoroughly for your claim file.

What Items Can I Repair Immediately (Emergency Mitigation)?

🔹 Document everything before and during removal: Take photos and videos of all damage, removed materials, and emergency work performed. Keep all receipts.

These actions are encouraged to prevent further damage and protect safety:

• Water removal / pumping out standing water

• Removing soaked carpet, drywall, and insulation

• Boarding up broken windows or doors

• Tarping roof leaks

• Shutting off electricity or gas if unsafe

• Drying out property with fans, dehumidifiers, and air movers

• Removing mold-prone materials (if safe and documented)

• Securing the structure (temporary shoring or fencing)

Interior Property Materials Requiring Immediate Mitigation After a Flood

1. Drywall / Sheetrock

Highly absorbent and prone to mold within 24–48 hours

Must be removed at least 12–24 inches above the water line (a practice known as a "flood cut")

2. Carpet and Padding

Traps contaminated water and bacteria

Should be removed immediately—especially in Category 2 or 3 water (gray/black water)

3. Insulation (Behind Walls)

Fiberglass, cellulose, and foam insulation retain moisture

Must be removed once drywall is opened to prevent mold and rot

4. Baseboards and Trim

Often made of MDF or wood, they absorb water quickly and should be detached for drying or replacement

5. Flooring (Wood, Laminate, Engineered)

Buckles and warps easily after exposure to standing water

Must often be removed to allow subfloor drying

6. Subflooring

Plywood and OSB subfloors can delaminate and retain moisture

Needs thorough inspection and drying using professional equipment

7. Cabinetry and Vanities

If water-saturated from below, toe-kicks and particle board bases may swell and fail

Professional evaluation recommended before attempting to salvage

8. HVAC Ducting and Systems (If Flooded)

Water intrusion in ducts can spread mold and contaminants

Requires disinfection and sometimes full duct replacement

9. Electrical Outlets and Wiring (Below Flood Line)

Must be inspected by a licensed electrician

May need rewiring or breaker replacements if submerged

What Items Should I Wait On Until the Insurance Adjuster Arrives?

You should avoid full repairs or replacements of the following items until after the adjuster inspects and documents the damage:

🛑 Do NOT Repair or Replace Yet:

Drywall and Interior Wall Rebuilds

– Avoid reinstalling drywall, insulation, or trim.

Flooring (Wood, Laminate, Tile)

– Don’t refloor or refinish until damages are inspected.

Cabinetry and Built-Ins

– Leave damaged cabinets in place if safe.

Roof Replacement

– Tarp only; wait on permanent roof repairs until adjuster approval.

Electrical and Plumbing Repairs (non-emergency)

– Hold off on full rewiring, fixture replacement, or re-plumbing until approved.

HVAC System Replacement

– Don’t install a new furnace or A/C system without adjuster sign-off.

Appliance Replacement

– If flood-damaged, document them in place and leave for inspection.

Structural Framing or Demolition

– Do not remove walls, beams, or ceilings unless they pose an immediate safety hazard.

📸 Golden Rule: Document Before You Act

Photograph everything, including serial/model numbers

Save samples of flooring, drywall, or carpet

Make a contents inventory with estimated values

⏱️ Why Does Timing Matter?

Mold begins to grow in 24–72 hours

Insurance policies often require reasonable mitigation efforts

Delaying action may result in coverage denials or reduced payouts

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

AGENCY PUBLIC ADJUSTER LICENSES

MISTY'S PUBLIC

ADJUSTER LICENSES

SCOTT'S PUBLIC ADJUSTER LICENSES

Our Large Loss Specialties

Contact Us

LEGAL

Copyright 2026. ICRS LLC. All Rights Reserved.